ASC Adhesive Systems for Roof Assemblies – Insurance Incentives Summary 1

HUD PATH Contract No. H-21521CA

Insurance Incentives for Wind Mitigation Measures

March 2007 Summary

Windstorm damage to houses results in extensive property damage and extremely costly

insurance claims. Among the several failure mechanisms from wind that lead to water

damage and significant insured losses, the failure of roof deck attachment is a major

consideration. The loss of roof deck panels (e.g. OSB, plywood) during a high wind

event like a hurricane, quickly leads to extensive water damage to the building and its

furnishings. Insurance claim data shows that once a roof deck fails even partially, a

house becomes a major loss.

There are several practices which can be used to increase the strength of the roof deck to

roof frame connection. One such practice is the use of adhesives to increase the uplift

resistance of roof deck panels, which is the focus of the current ASC research project.

Further, incentives in the form of premium discounts are emerging in hurricane-prone

areas to encourage the use of such mitigation practices. This paper summarizes such

incentive programs in several states in the southeast U.S.

Florida

Since Hurricane Andrew struck in 1992, Florida has taken the lead in adopting regulatory

provisions related to hurricane resistant construction. Shortly after Andrew, Florida

Statute 627.0629 was adopted to require residential property insurance providers in

Florida to provide “discounts, credits, or other rate differentials, or other appropriate

reductions in deductibles” for residential properties where construction methods that have

been shown to reduce loss caused by windstorms are employed. Incentives are required

to be offered for mitigation techniques that address “roof strength, roof covering

performance, roof-to-wall strength, wall-to-floor-to-foundation strength, opening

protection, and window, door, and skylight strength.” Insurance providers are required to

provide a percentage discount range for the mitigation measure to the Florida Office of

Insurance Regulation to be available to homeowners.

In the years since Andrew, changes have been made to continue to improve the hurricane

resistance of homes. This is done predominately through building codes for new homes

and through insurance incentives for existing homes. The Florida Department of

Community Affairs and the Florida Office of Insurance Regulation are both active in

these arenas, and their efforts as related to insurance incentives are summarized below.

Incentives for Wind Damage Mitigation Measures

ASC Adhesive Systems for Roof Assemblies – Insurance Incentives Summary 2

HUD PATH Contract No. H-21521CA

Within this tool, adhesives are recognized as a wind mitigation measure affecting roof

deck attachment in retrofit construction, but not construction in or after 2002. The tool

lists measures in decreasing order of strength/incentive valuation. In decreasing order of

effectiveness for resisting uplift, the following wind mitigation measures are recognized

for roof sheathing to roof framing attachment:

• Plywood with 8d Nails @ 6/6

• Plywood with Screws/ Bolts

• Plywood with Structural Connection

• Plywood with 8d Nails @ 6/12

• Plywood with 6d Nails @ 6/12

• Plywood with Adhesive

Note that plywood with adhesive and plywood with 6d Nails @ 6/12 are only recognized

as wind mitigation measures for homes built before 2002. These techniques are not

viewed as improvements beyond the 2001 Florida Building Code, even though studies by

Clemson University demonstrated that retrofitting adhesives (whether two-part

polyurethane or AFG-01 compliant adhesive) at the joint of roof sheathing to roof

framing increases uplift resistance by 100 – 200 psf.

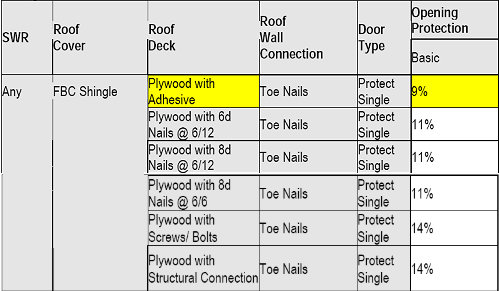

Example Chart:

Construction Type: Re-Construction

Year Built: Prior to 2002

County: Okaloosa

Number of Stories: One Story

Roof Shape: Gable

General Roof Deck Type: Plywood / OSB

Outputs:

Wind Speed Region: 110 MPH

Terrain Region: Terrain B

Windborne Debris Region: Non-Windborne Debris Region

Mitigation Incentives:

In the table above, various factors affecting wind mitigation are presented, such as

Secondary Water Resistance (SWR), type of roof covering, roof deck connection

methods, door type, and type of opening protection. For the example house described by

the inputs, the output indicates that the use of plywood with adhesives (in addition to

nails) to fasten the roof decking to the framing would result in a discount of 9% on the

wind portion of the total insurance premium. The wind portion of a homeowner’s

premium is anywhere between 15 and 70% of the total premium depending on the

location in Florida. The entry of “any” for the SWR in the table above indicates that the

insurer does not account for this factor in determining premium discounts. This

particular example is based on data supplied by State Farm Insurance of Florida. A user

can examine similar information for any insurer active in Florida, and can also cross

compare discounts offered by different insurers.

Impact of Incentives

Until recently, the guidance on the magnitude of incentives was limited to a general

percentage range. E.g. if a homeowner applies mitigation measure X, then he will

receive a 10-40% discount on the wind portion of the insurance premium for the house.

This level of information does not support decision making on mitigation measures,

because actual dollar figures are not provided.

The Office of Insurance Regulation has successfully lobbied for a change in the way

incentives for wind mitigation measures are provided by insurance providers. Recently,

the Florida Financial Services Commission passed a rule requiring insurance providers to

supply specific information on the value of individual wind mitigation measures based on

an individual home’s location, age, construction methods, and materials. This rule went

into effect in March 2007, and should provide actionable data for homeowners that will

let them decide the cost/benefit of implementing various wind mitigation measures.

However, it still appears that a homeowner must directly engage their provider to get

actual dollar amounts of discounts.

It is also unclear how broadly the mitigation incentives are being widely used by

homeowners. From conversations with DCA we were told that no broad PR campaign

has spread the word about the incentives. We have also been told by groups involved

with incentives that homeowners need to be very specific when talking to their insurers

about the discounts, or else the customer service representative may not understand the

request and find the appropriate information in their database.

Home Structure Rating System

ASC Adhesive Systems for Roof Assemblies – Insurance Incentives Summary 4

HUD PATH Contract No. H-21521CA

The University of Florida is currently under contract with the State of Florida’s Office of

Insurance Regulation to develop a Home Structure Rating System that will allow

homeowners to obtain an objective hurricane resistance rating of their home and

determine the effect of various mitigation measures.1 The contract was issued to fulfill

the requirements of Section 39 of FL SB1980, passed in 2006. Other participants in the

development of the rating system include the Florida Department of Community Affairs,

the Federal Alliance for Safe Homes, the Florida Insurance Council, the Florida Home

Builders Association, the Florida Manufactured Housing Association, the Risk

Management School at Florida State University, the Institute for Business and Homes

Safety, and Mercedes Homes of Central Florida. Input variables for the Home Structure

Rating System will include home location, age, and construction methods. Mitigation

measures that will be evaluated within the Home Structure Rating System include:

• Roof deck attachment

• Secondary water barrier

• Roof covering

• Bracing gable ends

• Reinforcing roof-to-wall connections

• Opening protection and

• Exterior door protection (garage door included)

The inclusion of roof deck attachment mitigation measures could spark interest from the

public in the use of adhesives, should the cost benefit analysis of this mitigation measure

prove favorable. The system and outreach materials are currently under development and

are expected to be delivered in May 2007.

Summary

Florida’s property insurance companies were the first in the nation to offer incentives for

wind mitigation techniques that are based on individual features.2 Florida’s statutes have

required insurance providers to incentivize wind mitigation practices which are shown to

reduce property loss caused by windstorms since 1994. The amount of the incentive

varies according to risk associated with the geographical location, building materials, and

construction methods of each home as well as actuarial data from individual insurance

companies. Within this established regulatory framework, there appears to be great

opportunity for recognition of both new and retrofit applications of adhesives for

increasing the uplift resistance of roof sheathing to roof framing, especially if previous

and future tests can be used to substantiate the increased structural integrity provided by

this application.

Other Gulf Coast States lag behind Florida, but there is clearly growing regional interest

in establishing programs which will give homeowners and builders incentives to apply

mitigation techniques. Depending on each state’s regulatory framework, such programs

may be optional or insurers may be required to offer mitigation incentives.

2 “Florida Hurricane Loss Mitigation Program Report to the Florida Legislature”. Florida Department of

Community Affairs. Jan 2002. http://www.floridadisaster.org/brm/RCMP/files/legreport.PDF. Accessed

7 Nov 2006.

There are no ways around it. In order to know ALL of the issues you may face when purchasing the biggest investment you will probably ever make in your lifetime, you need to hire a home inspector.

There are no ways around it. In order to know ALL of the issues you may face when purchasing the biggest investment you will probably ever make in your lifetime, you need to hire a home inspector. If you live in Florida, you are surrounded by water and face some of the world’s most fierce storms.

If you live in Florida, you are surrounded by water and face some of the world’s most fierce storms.